👋 Matt here. I’m stoked to share Build in Climate’s first guest post! In this deep dive, Will Yoo shares everything he’s learned from his eight(!) interviews. Tax credit transferability is typically an un-sexy topic that’s now looking a lot more attractive thanks to a glow-up provided by the IRA. I learned a ton and hope you do too! Now over to Will👇

Will in his own words

Will Yoo was previously an early product manager at Misfits Market where he helped scale their grocery delivery platform through COVID-19 nationwide. In his spare time he can be found enjoying sci-fi and movies. He’s currently open to exploring bold climate solutions and meeting collaborators interested in climate related projects.

Credits (pun-intended)

Shoutout to Allen Kramer (Crux Climate), Bryan McLaughlin (PwC), Jack Shadid (Hinshaw & Culbertson LLP), Phil Mixon (The Wilson Firm), David Burton (Norton Rose Fulbright), Andy Moon (Reunion Infrastructure), Alfred Johnson (Crux Climate), and Erik Underwood (Basis Climate) for contributing to this post.

Tax Incentives in Energy Are Not New

Tax policies impact the literal air we breathe.

For example, take the oil and gas industry. Since 1916, intangible drilling costs (IDCs) can be immediately expensed by oil & gas developers. Everything that’s not drilling equipment is an IDC - drilling mud, fuel, wages. And they are 70-85% of the cost of an oil well. This preferential tax treatment for oil and gas massively subsidized the industry and has been going on for over 100 years.

Thankfully, over the years industrial tax policy has shifted from supporting the oil & gas industry to encouraging the use of renewable energy. The Energy Policy Act of 2005 subsidized and extended tax credits for wind and hydropower. During a period in which tax equity investors were few and far between due to the banking crisis, the American Recovery Act of 2009 bridged renewable energy by providing grants and extending the availability of tax credits.

The Inflation Reduction Act of 2022 (the IRA) is the next giant leap forward for U.S. energy policy and supports renewable energy and certain related infrastructure on an unprecedented scale. It’s the largest investment in energy policy, in any country, ever.

The Tax Credit Value Chain

To understand the IRA tax incentives it helps to understand the adjacent world of tax equity.

There are many stakeholders involved when it comes to structuring a traditional tax equity transaction. This is typically how renewable energy developers have monetized the subsidies Congress has provided them.

With the IRA in place, creating value from tax credits will change due to the new transferability rules. Transferability opens up an entire new market in who can benefit from tax credits by making them transferrable.

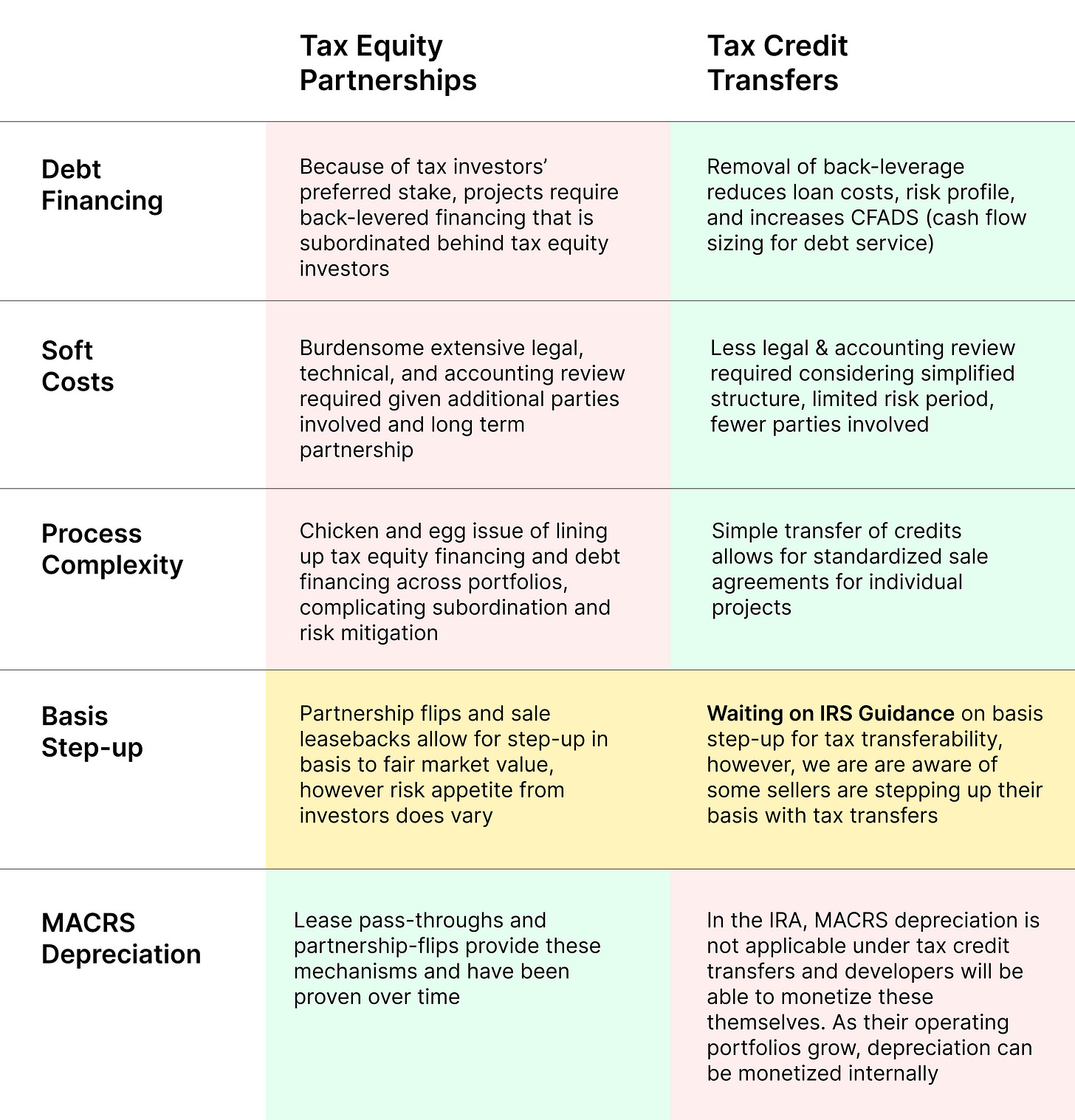

In the old world of tax credits, the ability to monetize tax credits was concentrated in a small number of financial institutions. In the past, banks would execute complicated tax-equity transactions that were often in the form of partnerships that had ownership of the project. These bespoke and complex deals take a lot of legal and tax expertise. JP Morgan and Bank of America are two of the major players in this $20 billion market. These transactions allow the financial institutions to reduce their tax bills while still receiving some of the returns in cash.

This market structure comes with a few issues though. It’s highly specialized and controlled by a few major financial institutions. Also, it’s demand constrained. If tax liabilities decrease in a certain year, the market for tax equity could shrink. Since there are only a few “buyers” like JP Morgan and BoA, the size of the market fluctuates frequently.

Traditional tax equity partnerships are still going to exist. But with transferability rules in place, any corporate entity with tax liabilities can now buy tax credits. The demand side for tax credits has gone from a few big banks with the proper expertise and staff to any C corporation with a material tax burden.

Changes with the IRA

With the new transferability rules within the IRA, the market will shift and new opportunities will emerge.

Now that entities unaffiliated with the actual project can purchase and lower their tax liabilities, more buyers are incentivized to come in. This is a new asset class that corporate tax professionals have never had access to.

Imagine leading retailers like Target or pharmaceutical companies like Bayer purchasing tax credits directly from project developers. The universe of buyers would proliferate, and the market could move a lot more tax credits. Democratizing monetization of tax credits supercharges the development of clean energy infrastructure.

We’re already starting to see corporations participate in transfers. Vitol, one of the largest private energy traders with $505B in revenues and $15B in net profits recently reached an agreement to purchase $100 million in production tax credits (PTCs) from Avangrid, a $41B publicly traded renewables developer. When asked about the potential for the IRA, Avangrid’s CEO Pedro Azagra said “the Inflation Reduction Act offers an unprecedented stable framework, enhancing the attractiveness of renewables.” Expect to see more profitable companies like Vitol make massive purchases in the coming years. Another major deal was First Solar selling $700 million of 45X manufacturing tax credits for $.96 on the dollar to Fiserv, Inc., a fintech company.

But how do the credits actually work?

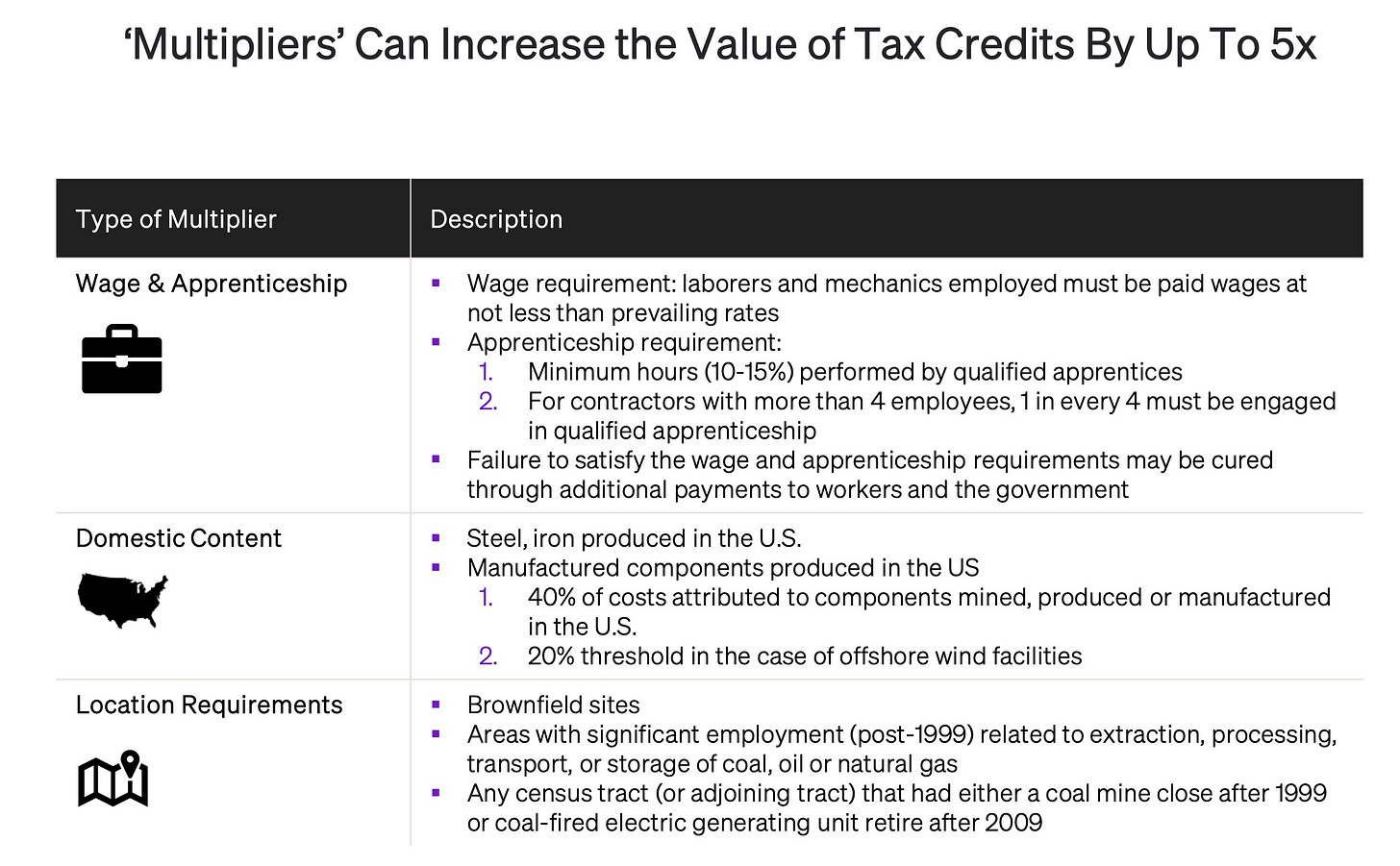

Energy developers can earn credits and sell them to someone else. This enables 30-50% of project costs to be monetized immediately. To get to the maximum of the 30-50% range, the project must qualify for bonuses. The main bonus is the wage & apprenticeship bonus (W&A). This W&A bonus is super important because it ties energy policy to labor policy and is a massive commitment to creating green jobs.

W&A is also the largest bonus, providing 5x the amount of incentives if a project qualifies. To be more specific, W&A gets a project from for instance a 6% ITC to a 30% ITC. (this bonus would not be a 5x of 30% to 150%.)

Specifically, the IRA includes 13 different tax credits across industries. There are consumer credits like for purchasing electric vehicles or upgrading your home, but for the purpose of this piece, let’s focus on corporate credits because they’re transferrable and therefore can be monetized by corporations.

Tax credits impact a wide variety of industries and companies. For example, Charm Industrial uses plants to capture CO₂ from the atmosphere. They qualify for the carbon sequestration credit. Other companies may qualify for advanced manufacturing production under section 45X, by producing batteries, wind turbines, inverters, or other manufactured goods.

We can break tax credits down further by separating them into two buckets: production tax credits (PTCs) which incentivize production of clean energy and investment tax credits (ITCs) which subsidize the capital investment in new plants and projects.

PTCs are earned over time based on how much clean energy is produced. The PTC base rate is .3c per kWh produced and there’s a 1.5c bonus if the project meets wage & apprenticeship bonus requirements. These amounts don't reflect the inflation adjustment.

The ITC is a credit on the cost of new equipment and installation. Imagine that when the project is placed in service, the developer recoups 30-50% of the cost in the form of tax credits subject to meeting quality & assurance requirements. And with transferability, they can sell those credits to a buyer.

Each of the credits can be monetized in a couple of ways. First, the IRA allows for direct-pay which means that the government will pay cash to a qualifying entity whether they have tax liabilities or not. But these are typically difficult to qualify for since direct-pay eligibility requires status as a non-profit, tax-exempt organization, or a public utility. Certain credits like the 45Q, 45V and 45X qualify for direct pay even when the project is owned by a for-profit entity.

Transferability is key here. Project developers don’t have a ton of income tax liabilities to take full advantage of their earned tax credits. But with transferability, tax credits can be bought by companies with a lot of profit and tax liability.

Developers can transfer portions or the entirety of the tax credits to new buyers that have an incentive to lower their federal tax liabilities. Of course, developers accept some discount on the sale of a credit, in some cases, say 10%, of the value of the credit, in exchange for the liquidity. Experienced tax attorneys have seen credits trade at $.85 on the dollar or even lower.

Developers receiving cash for selling tax credits does not mean their projects are much less risky to start, but rather they can more easily recover a portion of the investment. This recoverability will attract more willing investors and more capital which in turn will result in more projects being developed. More projects means more green jobs. If all goes well, the IRA will set off a positive feedback loop of clean energy development.

Over the next decade, it won’t be surprising if corporations' tax and treasury functions have to learn the ins and outs of tax credits. With all of these changes, there will be a boom in business not only for project developers and financiers but for lawyers, software companies, specialized insurance providers and other market participants that add liquidity and efficiency to the tax transfer marketplace.

Produced by innovative developers and backed by the government’s guarantee, tax credits may be a key catalyst of this clean energy golden age.

How To Sell Tax Credits

Imagine you’re a solar developer planning a new project. In the planning stages, you’ll engage with specialized advisors on tax equity and the IRA changes including an accounting firm like CohnReznick or a law firm like Norton Rose Fulbright to understand which credits you’re eligible for. They’ll also help you prepare for the buyer’s due diligence and document the sale transaction. These service providers provide guidance on how to comply with bonuses and maximize the value of credits.

Specialized software providers like Crux, Basis and Reunion have all taken different approaches to making liquid marketplaces to transact credits for new corporate buyers and developers. Facilitating these complex transactions adds efficiencies and liquidity to what historically has been a bespoke transaction. These startups have the potential to greatly improve the transparency and liquidity of tax credits just like how AngelList and Carta transformed investing in startups and managing equity. In the near future, a buyer on one of these marketplaces may be a large, profitable brand like Nike that wants to both lower their tax liability and help new energy projects get off the ground.

This whole ecosystem is permitted by the IRA until at least 2032 or until CO2 emissions are below 25% of 2022 levels. Some firms like Wood Mackenzie are stating it could take until 2044 to reach the 25% levels. Given that the IRS also allows for projects to go into production years after qualifying for credits and the phase-out period, credits could continue flowing into the 2050s.

Wood Mackenzie on IRA phase-out:

Once the 25% threshold is reached, the three-year phaseout ensures that projects entering service through at least 2047 will be eligible for the technology-neutral tax credits. However, the Internal Revenue Service’s (IRS) Continuity Safe Harbor provision provides an additional nuance to this expectation. Under this provision, projects are allowed to reach commercial operations up to four years after they initially qualify for either the PTC or ITC.

Thus, a project qualifying for a tax credit in 2047 has until the end of 2051 to commence commercial operations. If the IRS continues to allow for Continuity Safe Harbor in the future, we expect projects entering service for nearly the next 30 years to receive the technology-neutral tax credits.

Still, the market remains very early. The IRS continues to publish new information. In December 2023, the IRS published guidance on new credits. The IRA has kicked off a swath of “mega-deals” amongst the world’s largest developers and most profitable companies. Champions of older tax equity structures like Bank of America are making multi-billion dollars deals with giants like Blackstone and Invenergy. Meanwhile an ecosystem of startups are emerging to facilitate what the IRA provisions.

Increased Role of Intermediaries

Intermediaries play a crucial role within the tax transferability market. This is nothing new. Specialized intermediaries have existed for other, ‘non-climate’ types of tax credits. For example, in order to qualify for R&D tax credits a company could engage a provider like MainStreet or Neo.Tax. In particular, IRA tax credits are special because they’re specialized and high value. There’s over a dozen of them and they could be worth billions of dollars per transaction. With numbers that size, compliance becomes important.

Given the size of the transactions, specialized insurance firms offer indemnity and protection in case something goes wrong, like if a project doesn’t get finished or doesn’t produce the amount of energy it thought it would. Professional services firms like PwC assist with both supplier and buyer education, due diligence, and verifying the value of a credit. Due diligence can get difficult because of the “adder” requirements and the fact that firms have to keep track of payroll records for a long time, even after the credits are monetized.

Keep in mind these are bespoke, specialized, high value transactions. Even in the future, a corporate tax professional isn’t going to be transacting tax credits on eBay or Coinbase. It’s more likely that the tooling, marketplaces, and software will resemble AngelList, Carta, and specialized brokerages. Improving the user experience in transacting tax credits is helpful to some extent, but these transactions are complex and require industry expertise that go beyond nice-looking websites.

Just How Big is the Market?

This is going to be a very large market with many transactions. Many of these tax credits are uncapped which means there’s no upper limit in terms of how much they can be redeemed. This explains why Credit Suisse estimates of ~$576b are triple of the Congressional Budget Office estimate.

Credits can be divisible and sold by a single developer to many buyers. On the supply side, given the diversity of credits, from solar to wind to advanced manufacturing and clean hydrogen, there will be 1000s of suppliers tapping into tax incentives.

Given the pace of the market, venture-funded companies like Crux, Reunion and Basis are creating platforms to connect buyers and sellers of tax credits. Each of the companies are founded by extremely experienced teams, either working on massive energy and renewables projects. The founders of Crux, Reunion, and Basis said this is the fastest growing market they have ever seen. One of the main challenges is simply keeping up with the pace of the marketplace developing and the insatiable appetite for tax credits coming from buyers and sellers. The founders also believe the market is likely to be demand constrained in the long term. They stressed the importance of educating the corporate buyer base. Many corporations who are potential buyers still aren’t even aware that these tax credits exist.

All in all, the tax credit market is a many-winner market that will be large enough for multiple startups, service providers, and developers.

Innovations in the Market

With mega projects, nearly 30% of CAPEX are subsidized by tax incentives with the other 60% usually debt and 10% in the form of equity. Being able to de-risk up to 30% of the return profile of a project makes U.S. projects a lot more attractive to investors. The second order effects of these policies means that foreign capital will invest far more in the United States.

Credits and capital allow for developers to be more ambitious for their projects because there’s less risk and more capital. There are already massive first-of-a-kind (FOAK) projects and transactions that are using these incentives at scale. For example, the purchase of American Electric Power’s 1.37GW renewable energy portfolio for $1.5 billion.

On the enablement side, companies like Crux, Reunion, and Basis are making what are these bespoke transactions with many stakeholders far more efficient and liquid. In the tax credit world, these startups serve as multi-sided marketplaces where financiers, developers, and buyers can transact tax credits efficiently.

Impact on Jobs

The inclusion of wage & apprenticeship (W&A) requirements to get the full 30% rather than 6% on certain credits emphasizes the importance of skilled labor in the global energy transition. Meeting W&A requirements is the only way to get the full value of the tax credits. The labor bonus is how energy & labor policy intersect in their goals.

Developers must pay union wages and employ certified apprentices in order to qualify for bonus rates. They don’t have to hire union labor, but they do have to pay union wages. The qualifying apprenticeship condition states that the labor must come from registered apprenticeship programs. This obviously puts a burden on the entity applying for bonus rates, but also, the incentives are massive. If W&A requirements are met, the credits are 5x’d. If all goes well, the IRA should have a massive impact on the skilled labor base. Hopefully, this 5x bonus for projects that employ certified apprentices and pay union wages will greatly accelerate the creation of viable apprenticeship opportunities.

Every developer is putting in the effort. Almost everyone I spoke to echoed that it’s table stakes to pay prevailing wages, make an effort to recruit apprentices, and go after the maximum amount of credits possible.

On the other hand, it’s unclear how many net new jobs will be created due to the IRA. One professional services provider who has advised billions of dollars in tax equity transactions is skeptical. He mentioned that most developers were already paying prevailing wages due to tight labor markets.

The extent to which these requirements are met are covered in the insurance products coming to market, and companies will have to keep detailed payroll records for prevailing wages, employing apprentices, and making good faith efforts to provide opportunities.

Overall, every guest I spoke to is a fan of the intent behind the policy to create good green jobs. The Biden Administration is following through on the campaign promise that Green Jobs are Good Jobs and is making a bet that it can incentivize investment into the skilled labor workforce. Director of the Office of Energy Jobs Betony Jones believes tax policy will be a key part for the department to meet its goals.

Still, the policy is a massive step in the right direction and aligns incentives of developers with the increasingly important role of registered apprenticeship programs. A clean energy economy can not only coexist, but thrive with a growing labor base. Whether or not there is net new job creation is a question for the future. At least incentives for good faith efforts have clearly been put in place.

Carbon vs. Tax Credits

There is an important question to ask about the role of tax driven policy in industrialization versus new markets that are emerging, like voluntary carbon markets. Another hot area of alternative finance to compare to is the development of advanced market commitments (ACMs) and the purchasing of carbon offset credits.

There have been incredible developments in the realm of voluntary carbon offset markets. Stripe Frontier for example started as a $1M commitment to purchasing voluntary carbon offsets from innovative providers like Charm Industrial. They have since upped that commitment to $1B. Still, the market for voluntary offsets remains early and speculative. There are no government backed guarantees that create a market structure for transactions to take place in voluntary carbon markets.

The total amount of removals purchased is estimated at $2.1b as of December 2023. Compared to the government-backed market of tax credits at $800b, it looks small in comparison. Researching the state of tax credits vs. carbon removals made me think of a bunch of open questions:

On the buyer side, how should corporations think of allocating funds towards tax credits vs. voluntary carbon removal markets? Will they do both?

On the supply side, how well do current carbon removal methods scale? Could they meet the demand if it was there?

Considering tax credits have explicit government backing and a long-running history of effectiveness in spurring industrial activity, they seem more promising than the voluntary carbon market. This is not to say we shouldn’t embrace both on the path towards sustainable industrial policy, but that the tax credits market is less speculative than voluntary carbon markets.

Our community of climate leaders have to ask really hard questions about what solutions are the most promising and where investments in talent, capital, and energy should be made. Regardless of where these two markets are in relation to one another though, we must explore every avenue to encourage innovation in how we transition to a clean future. In terms of measuring relative benefits, I believe we should focus far more on maximizing the value of tried and true market interventions like tax credits. With that said, I’d be interested to hear from a corporate buyer of both removals and tax credits to understand how they think about purchasing.

Tax Industrial Optimism

There has never been a more exciting time to dive into tax credits! Using the levers of tax policy is how the U.S. originally developed a reliance on fossil fuels. We’ve come full circle with the IRA enabling market tax transferability which will hopefully finance a far cleaner energy transition. We’re already seeing real transactions, but it’ll take at least another decade to play out.

Still, questions remain for the wider climate community to think about:

How effective will this market be in creating green jobs?

How should we think about the relative importance of tax credits versus carbon credits?

What is the long-term durability of tax credits as an asset class?

Credits & Careers

Again, a special thanks to all of the guests: Allen Kramer (Crux Climate), Bryan McLaughlin (PriceWaterhouseCoopers), Jack Shadid (Hinshaw & Culbertson LLP), Phil Mixon (The Wilson Firm), David Burton (Norton Rose Fulbright), Andy Moon (Reunion Infrastructure), Alfred Johnson (Crux Climate), and Erik Underwood (Basis Climate) for contributing to this post.

If you want to make a big impact with your skills consider working with some of our guests on making tax credits transferable.

A few impactful roles are linked below:

Careers at Reunion

Careers at Crux

👋 Matt again. If you made it this far, just two last things:

Feel free to reach out to Will over LinkedIn

If you’re interested in writing a future guest post, reach out to me!