🚕 Charging into Fleet Electrification #023

a step-change transformation at the intersection of energy, transportation, and real estate

A huge welcome to the 65 new readers who have joined us since the last post! If you haven’t subscribed yet, join 730 climate curious folks by subscribing here:

As always, thanks for the support 🙏

TLDR: Fleets are an important, yet complex portion of the transportation sector that will need to be electrified. I interviewed Katie from Flipturn, Darren from Cruise, and Ethan from Keyframe to learn more.

A fleet is simply a collection of vehicles. You could have a fleet of one or a fleet of thousands. Although a wealthy household with many children could technically have a fleet of cars, we typically refer to fleets as vehicles associated with commercial use cases.

There’s many types of fleets. Within logistics, there’s cross-country semi-trucks that travel thousands of miles across interstate highways. There’s last-mile delivery vans like UPS and Amazon. There’s also drayage — the big trucks that transport shipping containers on short trips from coastal port to shipping facility. For transportation, there’s public transit, school buses, and ride-hail fleets. Fleets can also be owned by companies whose main business isn’t directly operating the fleet. For example, Genentech operates their own fleet that safely and reliably moves their drugs around.

Even though fleets and their respective businesses can vary significantly, they have a lot in common. Whether it’s heavy-duty trucks or customer-engineered vans equipped with cold chain, these vehicles tend to come at a high price point and serve a critical purpose in a company’s operations. Running a profitable business comes first, so unit economics is often more important than brand, comfort, or even sustainability. Fortunately for the planet, as the cost curves of renewables, electric vehicles, charging infrastructure, and batteries come down, switching your fleet to electric will become a no-brainer — if it hasn’t already.

Comparing fleets to consumer vehicles, there’s a few key points to be made. First, fleets are heavier emitters than consumer vehicles on a per vehicle basis. Even if you commute to the office everyday, that pales in comparison to the miles that an Uber driver or Amazon delivery driver would do. By targeting the most carbon intensive transportation segments, we’ll get more bang for our electrification buck.

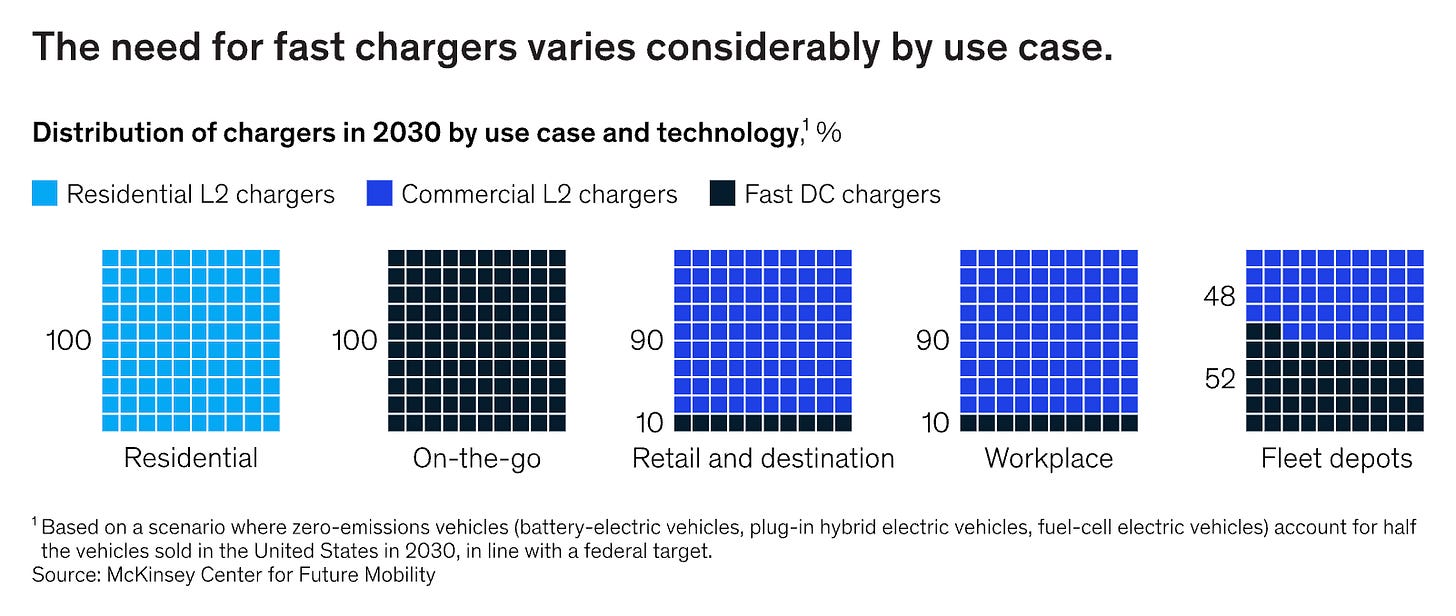

The other difference is what I’ll call charger type tolerance. Residential EVs can be easily charged overnight in your garage via a Level 2 charger. With fleets, there’s less flexibility. Since fleets put on more miles, tend to be heavier, and have a higher aggregate power demand (since there’s multiple of them all in the same place), higher power chargers are needed.

Today, a majority of EV news coverage goes to consumer EV brands like Tesla, Rivian, and Lucid Motors. In fact, I didn’t understand the sheer scale of fleets until I started researching for this piece. In keeping a steady aim towards the goal of net zero, it’s important to objectively seek out the most impactful solutions. Even if it means electrifying a bunch of big trucks tucked away in warehouses instead of drooling over Cybertrucks.

Introducing Katie, Darren, and Ethan

Since I know very little about fleets, I reached out to three experts who do:

Flipturn is the unified control center for EV fleet and charger operations. By integrating with vehicle telematics systems (devices that sit in the vehicle and send data like GPS, fuel level, state of charge, etc), Flipturn enables fleets to maximize uptime and minimize utility costs by optimizing energy usage with charger management, analyzing cost and range, avoiding operational issues, and more.

On the charger side, they are hardware agnostic and able to connect to any private charger. Since the product can directly talk to on-site chargers, Flipturn can directly control the power level of the chargers. The centralized dashboard enables fleet operators to manage all of their chargers and vehicles.

At Cruise, his teams cover charging operations and service, product strategy for what hardware and software to buy, and infrastructure automation which includes prototyping and deploying robotic chargers. Fun Fact: all of Cruise’s autonomous vehicles are fully-electric and Cruise is one of the world’s largest fully-electric fleets at this moment.

TeraWatt is an asset-heavy business that owns real estate, develops fleet charging depots, and contracts them out to a variety of customers. The physical product is complemented by software that coordinates charger reservations, energy management, billing, maintenance, and 24/7 customer support.

I’m excited to share what I learned from these three experts because they have each been/are founders and also bring other perspectives. From the inside of Cruise, Darren has seen how problems morph as a fleet scales and how sometimes the job gets done with Frankenstein-y solutions. From starting TeraWatt in 2018, Ethan was relatively early to the fleet electrification transition and is now trend-spotting across adjacent areas as an investor. And of course, Katie brings her own experience with fleets from Samara which then has the additional layer of electrification added on top. So without further ado, let’s get right into it!

Charging needs of fleets and consumer vehicles are different

Ethan from Keyframe: We founded TeraWatt with the thesis that fleet charging was going to have a different set of needs than consumer vehicle charging. For example, fleet operators were going to heavily prioritize location, access, and the ability to charge according to their existing schedules and fleet operating parameters. Similarly, the sheer scale of implementation is significantly different for fleet operators. Instead of charging 10 vehicles at a time, they would need to charge tens or hundreds of high-powered commercial vehicles at a time. This amounts to megawatt hours of power at a single site, resulting in very large scale energy projects.

Fleets care about uniformity and will electrify in step-change patterns

Ethan from Keyframe: We believe that we're going to see a step-change adoption of electric vehicles by commercial vehicle fleets of all vehicle classes. We see the total cost of operation as a primary factor driving this step-change adoption. Because fleet operators are almost exclusively driven by economics, once we squarely reach total cost of ownership parity or better, we believe it will be clearly advantageous to electrify. With this clear economic advantage, we expect fleets to make the economic choice to switch in a step-change function instead of a huge overhaul needing mass education and time. The passenger vehicle market, on the other hand, might need that mass education to electrify over a much longer period of time.

Another primary reason for the step-change pattern is that fleets like uniformity, at least on an operating site basis. Operating a fleet is very complicated, so removing as many variables and having as much uniformity as possible is a huge priority. Therefore, to preserve uniformity on a location-by-location basis, we expect fleet operators to transition full locations at a time to EVs.

Matt: That's an interesting insight that I hadn't thought of. It seems like there's sort of activation energy needed. What are some of the key moments leading up to when a fleet is ready to fully electrify?

Ethan from Keyframe: Well, there’s a caveat to my prior statement regarding location-by-location adoption. Many fleets are currently testing one or two EVs per site. They do that before making the decision to transition the entire site to EVs. The number one question that they're asking is “How are we going to charge all of these vehicles?” Fleets initially expected to be able to charge them all on their existing operating sites. While they can do that for one or two vehicles, by the time they start thinking about their entire fleet, the power and physical space needs become limiting factors at their existing site. Off-site solutions – that’s where Terawatt comes in!

What problems do fleet operators face?

Katie from Flipturn: There are so many problems. One example is: a bunch of vehicles from your fleet come into the depot where you have the charters installed (since a lot of fleets install private charging behind the fence). All these vehicles come in and more of them come in than usual. Power demand spikes and you end up with a fee of thousands of dollars from the utility.

Another example: You plug in your vehicles and you expect them to be charged overnight. You arrive back in the morning and the charge session spontaneously stopped at 3 a.m. due to an issue with the charger and your vehicle isn’t charged. So you can't leave the next morning.

I'll give you a third example: You're running an EV program and you've heard on the news that EVs are cheaper to run than diesel vehicles because of the fuel costs. There's no way for you to know whether it's actually less expensive today because doing so requires you to calculate exactly how many kilowatts went into each time-of-use period from the utility company and then cross-reference that with the vehicle data that is difficult to access.

There's a long list of problems that fleet managers run into. It boils down to lack of ability to minimize charging costs when they're running their own chargers, and lack of cross-system visibility across vehicle, charging, and utility data. As well as the lack of analytics tools to understand how your fleet is doing so you can make the necessary efficiency and optimization improvements (that you currently have the visibility for your diesel vehicles).

Darren from Cruise: There’s a lot of hype in the space, but the biggest problems fleets have are foundational. The first one is getting access to grid power - this is where working together with your utility is really important. For example, there was a site that we were evaluating where the utility initially estimated the timelines for power upgrades could be over 2 years. Through continued engagement with the utility, they eventually proposed time-based access to power. They knew that at certain times of the day, other customers were not pulling as much power, so they gave us several additional megawatts during those times. We didn’t expect a utility to be that flexible on that front and were pleasantly surprised. A lot of people like to say that utilities are the problem and while utility timelines can be slow, I think they are partners and they can have creative ideas.

This is an example of a positive outcome, but sometimes you just won’t get access to power for years and need to stand up charging capacity regardless. That's one of the things that my team has dealt with. We’ve worked with a bunch of startups in the space to assemble what I call a Swiss army knife of stopgap power solutions. Depending on the volume of energy you need, you can use different technologies. For example, some service providers will perform battery swapping, charging those batteries up at one warehouse and then transporting them to your site. You can also use renewable fuels to power generators that charge your equipment. Obviously, we want to stay away from dirty fuels — and even carbon-neutral fuels have local emissions and noise impacts, but the fact of the matter is oftentimes the grid just isn't available. So we want to work with startups to find creative solutions that are as clean as possible to address the power shortage.

Another problem has been reliability and uptime of our chargers, especially with the fragmented non-Tesla ecosystem. By definition, you have a lot more complexity if you have to manage different suppliers because there’s no one holistically responsible for everything from the hardware to the service to the data. Essentially, uptime of the third party ecosystem is challenged. That can be due to a lot of different issues. It could be communications, robustness of the power electronics, HMI issues, payment module issues, etc.

There have been studies out there that estimated the uptime of chargers in the Bay Area to be 75-85%. For a consumer, it's very inconvenient and causes range anxiety. For a fleet, that's a no-go because there's a business imperative to keeping the vehicles running. If only 80% are working at any given time, you have to build in 125% of your chargers just to make sure that you can satisfy the fleet. That's very expensive. So, you have to proactively establish the tools and processes to achieve high uptime.

Nuances with an autonomous ride-hail fleet

Darren from Cruise: Let me first address the usage profile first. If you’re a last-mile delivery fleet that operates only during certain hours of day, you may have around 8 to 10 hours to charge overnight at the depot. In this situation, it makes sense to use Level 2 charging, which is almost two orders of magnitude less expensive than DC fast chargers. You can also leverage managed charging to minimize your grid upgrades and demand charges.

Cruise, on the other hand, expects over time to have 24/7 operations. That doesn’t mean that demand will be constant throughout the 24/7 hours. We do expect peaks and troughs that are similar to ride-share. But Cruise believes that as it scales its business and as the fleet matures and the costs go down for the consumer, that ride-hail demand will likely smooth out more than what we see in the typical peaky Uber and Lyft cycles. Because of this, Cruise needs to rely primarily on DC fast charging. You can think of the situation like an airline. You have really expensive assets that you want to keep utilized as much as possible so it can earn revenue for you. Since asset utilization is so important, you need the short turnaround times enabled by DCFC.

Matt: How do you think about the battery threshold levels and how that’s related to ride-hail marketplace dynamics? So for example, a static set of thresholds could recall vehicles when they’re below 20% and then release them at 80%. More intelligent logic could dynamically recall and deploy vehicles based on how much demand there is for ride-hail at any given time. The overall battery charge of the autonomous fleet is analogous to driver supply of human-operated rideshare.

Darren from Cruise: There are basically two ways to deal with this. One way is to think of it from a reactive standpoint and calling a vehicle back when a static or dynamic threshold is hit. But if you're reactive, you may not see a wave in demand coming, although it should be something that you can predict. One of the challenges in the ride-hailing business is that demand is stochastic, so there aren’t fixed scheduled routes that a bus or a last mile delivery fleet might have. As a result, you can't schedule cars to be charged at a given point in time. But what you can do is look at aggregate levels of demand and fleet level energy to create a confidence interval that can inform an SLA. You’re able to optimize charging and fleet scheduling at the macro level.

Power constraints and space constraints

Matt: If you took a city, like San Francisco, at what point do you start to think about having multiple charging depots? If you have just one and start adding more, you'll eventually hit the power limit. At some point, it might make sense to split, like how in biology, cells divide once as they grow.

Darren from Cruise: Not only is there a potential power constraint, there's also space limitations. You need a parking stall for a charging stall, but that physical space may not exist in one single location. You’d also want to consider additional locations to reduce deadhead miles. If constantly recall vehicles to one central location, they may be racking up unnecessary empty miles. We'd like to avoid that, both from an asset utilization perspective, but also from a climate perspective.

Overlap between optimal business and optimal charging geography

Matt: What does the overlap of the ride-hail business and the overlap of charging infrastructure look like? I visualize two heat maps. One is a heat map of ride-hail demand and the other heat map would be the optimal places to build charging infrastructure When you put those two heat maps on top of each other, what do you see?

Darren from Cruise: We've done some investigation on this front. You can certainly apply some simple algorithms to figure out the ideal placement, location, and size of charging depots based on ride-hail demand. The challenge is that we don't operate in an ideal situation. When you’re actually building this infrastructure, you have to operate with constraints, and some of those constraints would include zoning — are you allowed to even build commercial EV charging in this area? It might be a residential area. Maybe you can build charging, but you're not allowed to build it for commercial fleets. The second constraint is what's actually on the market. You may want to build a charging depot in one neighborhood and maybe it's zoned appropriately, but if there's nothing on the market, you can't build there. So there's just a lot of practical constraints.

What does the ideal charging depot location look like?

Matt: How would you describe the ideal location for a fleet charging site? Is it in relation to the proximity to the warehouse? The cost of the land? The power potential? How directly is it on route? What are all the sort of factors that go into an ideal location?

Ethan from Keyframe: I think you touched on several of them- like interconnection and route location. Other aspects of the site are also important, such as ingress, egress, or if it’s on a corner lot. For corner lots, you could do a drive-through charging (pull in one corner, pull out on the other.) Direct access to major thoroughfares and zoning is also extremely important, as municipalities often have specific requirements around the movement of truck and commercial traffic. Then of course, economics is key. We have to think about the purchase price of the underlying property as well as the full development expense. For example, it might make more economic sense to develop a site into a distribution center instead of an EV charging hub. The last one I'll add is the potential to build other amenities on the site. The potential to add, say, a driver lounge, office space, or even a warehouse can make a site more attractive.

Private vs. public charging

Matt: How do fleets think about what’s the right mix of private and public charging?

Katie from Flipturn: I think that many fleets are thinking about a mix of solutions and we're working with them to make it happen. You’ll often see fleets that want to install private charging because public charging is notoriously unreliable.

What we’ve found is that when they can, people want to install private chargers. But we're also seeing the rise of charging-as-a-service and fleet-as-a-service offerings. You could have a fleet that has their own private chargers, but they also have a deal with a charging-as-a-service company to top off or do opportunity charging at a different location if needed. It's also really important that this infrastructure exists so that there's an option to charge when needed, especially if it's far away from their depot.

Matt: Does charging ever take a top priority over the routing? In other words, would a fleet operator ever shift routes to optimize for charging? Today, I’d assume that fleets prioritize their deliveries or trips over fueling at a gas station. But with electricity and the way it's different than fueling, do you ever see that behavior changing in the fleets?

Katie from Flipturn: I think that the biggest issue is that a vehicle is often on a schedule, so it’s suboptimal to take a charging detour in the middle. Fleets often opt out of public charging and prefer to charge at the depot because it's cheaper and more predictable. As a result, instead of going on your route and being able to stop at any time at a gas station, you have to make it back to the depot. The reality is a fleet manager will not send a vehicle out on a route if it can't make it back. This is why it's going to be really difficult for long haul trucking to electrify, and that's why there's programs like NEVI to install chargers every 50 miles on the highway because of the range limitations.

What’s the role of software for fleet electrification?

Ethan from Keyframe: There are two important things I’d mention here about software. One is making sure that operations are working. One of the biggest pain points with charging today is uptime. It might seem relatively simple, but a critical part of building a business like TerraWatt is ensuring they are maintaining a high level of uptime. Software is what will enable that.

The second is optimization. A lot of this has to do with recharging vehicles at the optimal time across operations, cost of power, and charging availability of a site. That's a massive optimization problem that can be tackled with some planning, but also needs to happen in real-time. Software is going to be the solution here as well.

Load balancing with power controls

Katie from Flipturn: When fleets electrify, the two main complaints that we hear over and over again are range and charging. If you're installing private charging, getting your site hooked up to the grid to send enough electricity is pretty tricky. A system like ours can definitely help because we can control the power of the chargers. You can install more chargers than the capacity of the site, and then our software will load balance to keep it under that limit. That way you can have more vehicles simultaneously charging. You can rely on Flipturn to make sure that you stay below that limit and avoid tripping the breaker or incurring an extra fine from the utility company.

Matt: Even just the concept of setting the power limit is something that's unique to fleets compared to consumer vehicles, where in consumer, you just buy a charger off the shelf, you plug it in and you don't think about setting any of those limits. In fleets, it sounds like there's just more layers of complexity that you have to think about. It's not just the limit to avoid the fees, but it's also what you just mentioned about having multiple vehicles to think of.

Katie from Flipturn: Totally. It's completely night and day from residential charging. Fleet charging is a totally new problem and the reason why we're able to find success in the market is because a lot of existing solutions were built first for residential charging. You can imagine that all those assumptions break when you try to install a big depot of chargers with many vehicles needing to get out on time combined with the higher power needs. You need to tie it together with all these additional fleet systems.

The value of centralizing fleet operations in one tool

Katie from Flipturn: The area we get the most positive feedback on is simply the fact that you can see everything in one place. Fleets that adopt EVs sometimes often end up in a situation where they have one vehicle data platform for their diesel vehicles, another dashboard for your EVs, and then for each charging brand has an individual dashboard. So it's like 10 different places you need to look at just to understand what's going on with your fleet.

Fleet managers have to answer the question of “When will this vehicle be ready to go?” Or “Is this vehicle even charging?” It ends up being like a complicated problem to solve. If you're responsible for sending your drivers out continuously, it's extremely painful to have to go look into all these different systems so consolidating it into this single dashboard is extremely helpful.

Data flows and interoperability

Darren from Cruise: With regards to why the ecosystem overall is challenged on reliability, I think it's a few things. It's usually not because of the power electronics failing because manufacturing companies are very good at producing robust power electronics for industrial applications.

The charger is a complex system with a lot of parts. Just like cars have OEMs with different tiers of suppliers, the same thing happens with chargers. You may be buying a charger from a company like ABB or Tritium, but they may be integrating with parts from other suppliers - for instance, the payments system or cellular modem or HMI displays. I don't think any of these companies manufacture the charging cables internally. When you're piecing together all these different pieces, there's just more room for interoperability issues.

When something goes wrong, how do you quickly get through that chain to diagnose and resolve the issue? I think data sharing among the industry would really help the players across the value chain. There certainly are people who hold tightly to their data and think that there's some competitive advantage there. While that may be true, my take from the customer perspective is if holding tight to your data gets in the way of resolving the issue quickly, then nobody wins.

This is why Tesla is doing well. They made themselves the sole responsible party. They build the hardware, they have the teams doing O&M, they control the data flows that help them do the diagnostics, and at the end of the day, there's one party that's responsible if things don’t work. It's Tesla. In the third party ecosystem, it's more complicated. You play a game of telephone and even if people have really good intentions, that can be challenging. Now there are standards out there, like OCPP and OCPI that are meant to help with interoperability. I would say that they're not fully solving the problem because OCPP is a little bit more like guidance. Every manufacturer implements it differently. If you talk with any of Cruise’s suppliers, they'll tell you “We always have to do interoperability checks even though there is technically an interoperability standard out there”.

So I think there is space for improvement here. One of the companies is eDRV and they’re basically trying to become the Twilio of EV charging. They handle all the OCP integration with various manufacturers and they also manage some of the value add functions as well. For example, you’ll be able to know if someone's finished a charge session. Sometimes there are dropped messages and that can be an issue. They'll manage things like plug & charge from ISO 15118-20, which is also pretty complex. To the end user, they just have to hit an API endpoint since they’ll handle all of the OCPP and complexity behind it.

Skilled Labor in fleet charging

Darren from Cruise: Achieving high uptime requires hiring good people. I've built a team of craftsmen who care about the quality of their work, are safety focused, and have kind of a unicorn skill set. It's not a good idea to take a typical electrician and tell them to work on chargers because chargers are actually fairly complex.

You need someone who understands low voltage systems, but also high voltage systems. When you’re working with 480V 3 Phase or 800V DC, those are hazardous voltages. You need someone who understands how to do things mechanically, like torquing things to the right spec, doing pull tests, strain relief… all of these things.

Then you also need people who know how to debug. They need to be able to use software systems like a terminal. We like working with one of the companies in the space called ChargerHelp because they have a dual mission of training more technicians while offering this service.

Matt: You're mentioning skills that a technician would need to have that I wasn't even aware of. I guess in my head, I just visualize the car pulling up at the charger depot, a technician comes and plugs it to any of the chargers since they're all the same and then it just works. But what you're describing seems a lot more complex because chargers don't always work and there might be different types. If you plug it in and it doesn't work, then you need to troubleshoot.

Darren from Cruise: That's right. Frankly, in terms of processes, we've been trying to push as much of the early diagnosis further down to the user as possible. Sometimes when a charger doesn't work, the first thing you should do is just reset the software and try again. Training operators is pretty crucial as well. When we first started, we had a lot of cable breakages from the connectors being dropped. When they hit the ground and cracked, it became a safety issue. We had to replace multi-thousand dollar charger cables, so we worked on training procedures to reduce the number of these occurrences. I’m pleased to say we barely see any of these connector drops anymore.

The future of fleet electrification

Matt: What are you excited about today to invest in?

Ethan from Keyframe: In terms of things that interest me right now — or maybe things that are just top of mind —are battery development and stationary storage spaces. As we see renewable energy penetration increasing on the grid, we see with it an increasing need for storage to dynamically shift according to generation and consumption of energy. As battery prices decline, we believe the grid-tied, stationary storage market will benefit, largely driven by technology advancements in the electric vehicle space.

Matt: What’s needed as fleets continue to electrify?

Darren from Cruise: I think the data flows need to be integrated with a variety of charger data sources so that you have real time visibility of what's available and what's not. Charging optimization will also be needed and for a fleet like Cruise where you can actually control the fleet itself, it's going to be a bit of a joint optimization between the fleet and the chargers. I also think charging depots should become a point of resiliency, not stress. What happens if there's a blackout? Can you still operate your service? Do you have backup power? Lastly, how do you be a good citizen of the grid? These charging depots can pull megawatts of power and that can cause a lot of strain on the grid. Can you implement some managed charging scheme or fleet scheduling scheme that supports the grid rather than stresses it?

Matt: What does the future look like for fleet electrification?

Katie from Flipturn: The [fleet] industry has to adopt EVs. It's the number one form of clean transportation today and gets at the heart of transportation emissions. If we can't electrify large segments of transportation, it's gonna really hurt our efforts to combat climate change. So I see that there's going to be this widespread adoption of EVs across the commercial sector and there's going to be a ton of opportunity in providing software tools to help make charging seamless and easy. This starts with fleet charging. There's not a lot of support right now for fleets that need to charge and especially not a lot of support for fleet's specific needs, but in the future, I think there's an opportunity to bring together this entire ecosystem, connecting with charging-as-a-Service, bringing in data from public charging bringing in data from even being connected to residential chargers, all into a centralized platform.

Interested?

If you own EVs and/or chargers and are interested in management solutions, check out Flipturn!

Reach out to Darren if you want to talk about operating a fleet of hundreds of vehicles, how to procure and manage charging, and how to make fleet ops easier with data. He also wrote a great blog post called Why charging sucks and what to do about it.

Keyframe Capital is hiring an Investment Associate! You can apply here and let them know I sent you :)

Keyframe Capital Partners, L.P. (“Keyframe”) manages funds that hold this position within its portfolio. The information contained herein is for informational purposes only and is not intended to, nor shall it be, construed as legal, tax or investment advice. Keyframe makes no express or implied representation or warranty as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained herein. Neither Keyframe, nor any of its employees or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this interview or its contents or otherwise arising in connection with this interview.

This interview contains forward-looking statements that involve risks, uncertainties and assumptions. If such risks or uncertainties materialize or such assumptions prove incorrect, the results stated herein could differ materially from those expressed or implied by such forward-looking statements and assumptions.

Great stuff! You could also make a similar about heat pumps & maintenance management.

Great post - love the Flipturn team and have chatted with Darren a couple times. So much insight!