🌱 Accelerating Solar with Software #004

the solar landscape + open opportunities

Today’s deep dive is on Software in Solar. I start out by explaining solar energy’s role within the broader energy space and its mind-bending progression in adoption and cost reduction. Then I discuss how software can help by breaking down the solar sequence, from proposal to installation. I close with a brief overview of current solar software players, open opportunities, and some predictions. Let’s dive in! 👇

Why Solar?

Let’s rewind. First of all, why even energy? We must first understand energy’s contribution to the pie chart of greenhouse gas emissions (GHGs) in order to understand why “solar is king.” Objectively examining large problem spaces is critical in this context because perception ≠ reality. Instead of doing things that feel good and seem good, we need to know what’s actually causing the problem and then relentlessly attack it. In other words, we cannot paper straw our way out of the climate crisis.

Transitioning from fossil fuels to carbon-free energy sources is critical to getting out of climate crisis. Out of all global GHG emissions, 45% can be traced back to energy (Electricity and Heat Production, Transportation, and Buildings). However, shifting away from fossil fuels doesn’t imply that we can or even should shift completely to solar. There’s an entire menu of alternative energy sources to choose from, including wind, geothermal, nuclear, green hydrogen, biofuels, and compressed air. So why solar?

Solar is King

Solving the climate crisis will require a portfolio approach rather than betting all chips on solar. But there is a reason why it’s top of mind when we think about climate solutions. Given that the sun is actually a legit source of energy (i.e. the underlying technology actually works), it all comes down to basic economics of supply & demand. Over the last 40 years, solar PV prices fell 300x and total installed capacity grew 2 million fold:

When compared to other generation sources, solar continues to stand out:

You might be thinking, “This isn’t going to last forever. When is solar growth going to start slowing down? Well, there’s no sign of it slowing down anytime soon. In fact, the opposite is happening with the IEA consistently underestimating the growth of solar (they’re supposed to be energy experts):

It wasn’t always sunshine and roses (pun intended). The Cleantech 1.0 wave of the 2000s was filled with uncertainty about whether solar would ever prove economically viable. Now that we’ve crossed the threshold-of-doubt and solar is now cheaper than fossil fuels in many regions, we need to spend the next decade on scaling adoption and deployment as quickly as possible.

The future is already here, it’s just unevenly distributed. - William Gibson

For further reading, I highly recommend reading the entire Clean Energy Transition Guide by Tsung Xu (~1 hour)

Software’s role in climate

As someone who has only ever worked at software companies, when diving into this physical problem rooted in atoms, I wondered, “What can software do in climate?” Zooming out a bit, software has a few key advantages. With a powerful computer and the internet in each of our pockets, transmitting information now occurs at zero marginal cost. When we think about climate-friendly behavior changes like adopting rooftop solar, buying an induction stove, or switching to an electric vehicle, we visualize the physical product that we’re buying. However, there’s so much software under the hood including simulation, analysis, and digital interfaces that interact with the physical product. Not to mention horizontal aspects like sales enablement, financing, and project management that are more climate-agnostic. The end product may be physical, but nowadays software is everywhere, whether it’s directly embedded or playing a supporting role.

The 3 Solar Sectors

Like many, I’m guilty of initially assuming that solar is just a bunch of solar panels on residential rooftops since that’s what we literally see everyday. However, at a macro level, solar is much more than residential. In fact, the vast majority of solar energy is generated from commercial and utility-scale projects. The three categories are broken down by generation size:

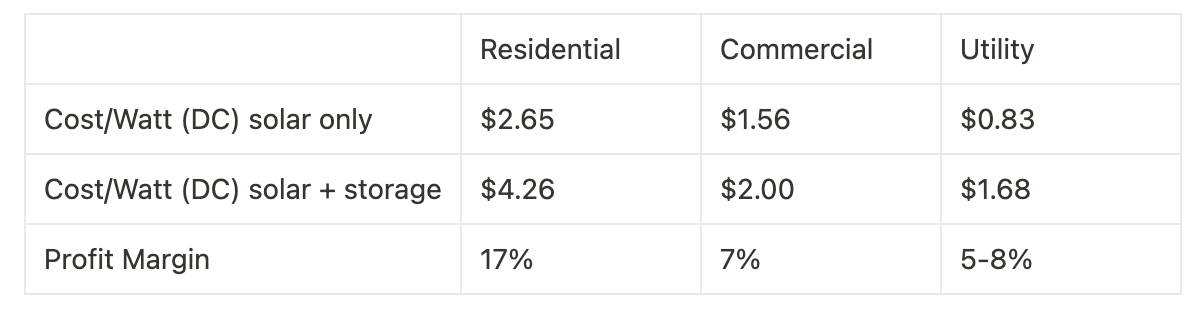

Residential (”resi”), commercial, and utility-scale differ not just in energy generation, but also in cost structure and profit margin. Interestingly, resi is the most profitable, but also the most expensive on a dollar-to-watt ratio. Utility-scale is the opposite by being the least profitable (on a percentage basis), but also the cheapest because of volumetric pricing and bypassing distributors.

The Solar Sequence

Although the actual process of installing solar varies a lot between project size, the core flow is largely the same. The over-simplified version is: Figure out where → Find the money → Figure out what to actually install → Build.

Here are the key steps (adapted from A Green Workforce Software Revolution):

1) Identification 🔎: enable developers to qualify leads and conduct initial outreach

2) Evaluation & Proposal 💻: evaluate homes and project sites for viability and create digital project specs

3) Financing 💰: help developers & installers source capital to underwrite the project

4) Design 📄: create digital designs for what, where, and how to install the solar project

5) Permitting 📝: get approval from local, regional, and state jurisdictions for the project

6) Interconnection 🔌: get permission from the utility to connect the project to the grid

7) Installation👷♀️: optimize workflows via project management tools which include customer support, procurement, and delivery of parts (similar to construction software)

8) Operations & Maintenance (O&M) 🛠️ : monitor and alert to handle any issues that occur post-installation

There are a couple key call-outs in the solar sequence:

Location: With utility-scale, the physical real estate of the project is one of the most important factors since so much of the costs are associated with the land itself. With resi, location is less critical since the solar must go on the buyer’s roof, although the exact positioning of the solar modules is still a factor in the design process.

Financing: Although each solar sector has their own stack of financing options, finding funding for utility-scale projects is critical since they’re often in the hundreds of millions of dollars. There are entire investment firms dedicated to renewable projects that, even with large fund sizes, still partner with banks to buy the project. In the industry, there’s this common term “bankability”, which is the willingness of a large partner bank to underwrite a project. It all comes down to the quality and durability of the solar modules and of course, cost - which can vary significantly between manufacturers.

Sales & Marketing: The utility companies are the customers of utility-scale solar so for them, buying renewably-generated electricity is one of their top priorities. There are certainly relationships that need to be built and maintained, but having to market and sell the idea of solar energy isn’t as necessary compared to resi rooftop solar. On the other hand, the resi world resembles consumer home improvement like roofing or energy efficiency upgrades. More customer awareness needs to be built since homeowners typically don’t think about major changes with their homes unless something breaks. So in order to reach and then convince homeowners to go solar, more headcount and dollars are allocated to sales & marketing in resi solar compared to other solar sectors.

Breaking Down Costs

The physical act of installing rooftop solar is more than just a person climbing on a roof with hardware and tools. There are additional steps where software plays a major role in, such as marketing, sales, design, permitting, and interconnection. In fact, improving these parts of the solar sequence (soft costs) will be key in reducing up to 2/3 of the costs of solar:

Regional Differences

It’s fair to assume that the best place to install solar is wherever the sun shines brightest, but there are other factors at play. For example, in the US, the Northeast is a favorable region for solar due to policy, which not only influences pricing via rebates and tax incentives, but also helps to streamline permitting and interconnection.

By streamlining permitting and interconnection, while still paying similar amounts for hard costs and labor, Australia has managed to achieve 3x cheaper solar (measured in $/watt) compared to the US. The differential is in soft costs - where software has an outsized opportunity to improve.

Permitting can take as little as a day in Australia and is done over the web; in the United States permitting and connecting to the grid can take as long as six months. - Saul Griffith

I’m also excited about the potential for solar in developing regions. According to the World Economic Forum, Africa has the highest solar energy potential, but is also at risk in terms of climate impact. From a climate justice perspective, it’s tragic that a region which contributes just 4% of global emissions stands to face some of the most extreme weather, food shortages, and mass migration. On a more optimistic note, I’m looking forward to seeing solar play a key role in bringing electricity to the large percentage of the world that still doesn’t have any electricity today. As of 2020, less than 50% of sub-Saharan Africa had access to electricity. There are other examples. In Lebanon, the state-run utility has only been providing *two* hours of electricity per day which has led to a solar boom. Technologies like solar combined with storage could enable rural populations to leapfrog over the traditional grid model, much like how China as a society was able to leapfrog over personal computers and go straight to smartphones.

Existing Players

There are a ton of existing solar software companies out there. This market map from Equal Ventures highlights specifically B2B SaaS companies that sell to resi, commercial, and utility-scale solar developers:

Across this sea of software, a common pattern emerges: start with one part of the solar sequence, do that well, and then expand to others. Aurora Solar is a stellar example of this strategy playing out. They began by generating proposals for resi installers by leveraging mapping data which saves the installer from having to conduct an in-person evaluation. Since then, they’ve expanded their product into the sales cycle to empower lead generation and documentation management. Poking around their careers page indicates that they’ll continue to expand into another key step in the solar sequence: permitting.

For solar software companies, B2B SaaS is a compelling approach and perhaps is the path of least resistance given greater willingness to pay and stickier customer base than consumers. However, there are other modes to operate in.

Vertical Playbook - the SunRun strategy

Given the solar industry has had more time to mature than other climate areas, the industry has had a considerable amount of consolidation and as a result, a few giants have emerged. These big players like Tesla (with their acquisition of SolarCity), SunRun, SolarPower, and others have structured their businesses so that they can control as much of the solar sequence as possible. How “verticalized” each business is varies. For example, Tesla not only manufactures their own solar modules, but also handles the entire customer-facing experience including evaluation, proposal, and design. These solar giants benefit from economies of scale, but this doesn’t mean the vertical strategy playbook is bulletproof. Given the local, physical, and quite personal nature of resi solar, an aggressive land grab expansion strategy can lead to gaps in customer service, reliability, and ultimately customer trust:

Aggregator Model

From the homeowner’s perspective, solar modules are a commodity. Making a purchase of thousands of dollars is no quick decision so prospective buyers inevitably feel compelled to do a bit of research beforehand. As a result, all sorts of review sites and aggregators have emerged. EnergySage, a solar software veteran, prompts for your address and some other quick questions. Instead of actually offering useful recommendations, they just give your email to a bunch of companies who then spam your inbox. On the brighter side, Wildgrid is a sleeker, more modern version of EnergySage that seems to appeal to the Gen Z and Millennial audiences. Wattbuy is another aggregator that also offers other home electrification solutions. These companies are approaching residential solar with the same playbook: meet the customer at the sign of initial interest, walk them through the process with recommendations, and then collect an affiliate fee on completed sales.

Note: This was from a comprehensive view of all solar software companies. In reality the differences between resi, commercial, and utility-scale solar are distinct enough that they should be thought of as separate entities. Viewing the solar sequence as one core flow for all solar project sizes may be overly simplistic, but it keeps it high-level enough to grasp the key concepts.

Open Opportunities

The presence of existing solar software companies should not deter emerging founders from investigating this space. From over 20 phone calls with solar installers, climate investors, solar nonprofits and employees at solar software startups, a few key opportunities emerged:

Permitting

Once you’ve decided to go solar and figured out how you’re going to pay for it, the next step is to get permits. What does it entail? Well, the application form usually is 10-15 pages long and reviews the electrical and structural design of the project. This includes solar panel wiring diagrams, fire safety rating, placard placement map for PV systems, and certifications for the panels and the mounting hardware.

Receiving approval at the city, county, and sometimes even neighborhood level requires going to each layer of bureaucracy for separate approval. Since each jurisdiction operates independently, the format and structure of the permitting process can vary from place to place. Sometimes permitting can be a breeze. For example, a local Bay Area solar installer told me:

The Brentwood permitting office is pretty good. If you decide pretty quickly we can get your survey completed in a week or so and from there we get your design and plans done, this can take about a week. We would have you approve them first, and then off to permitting. At that point we order materials and book your install date.

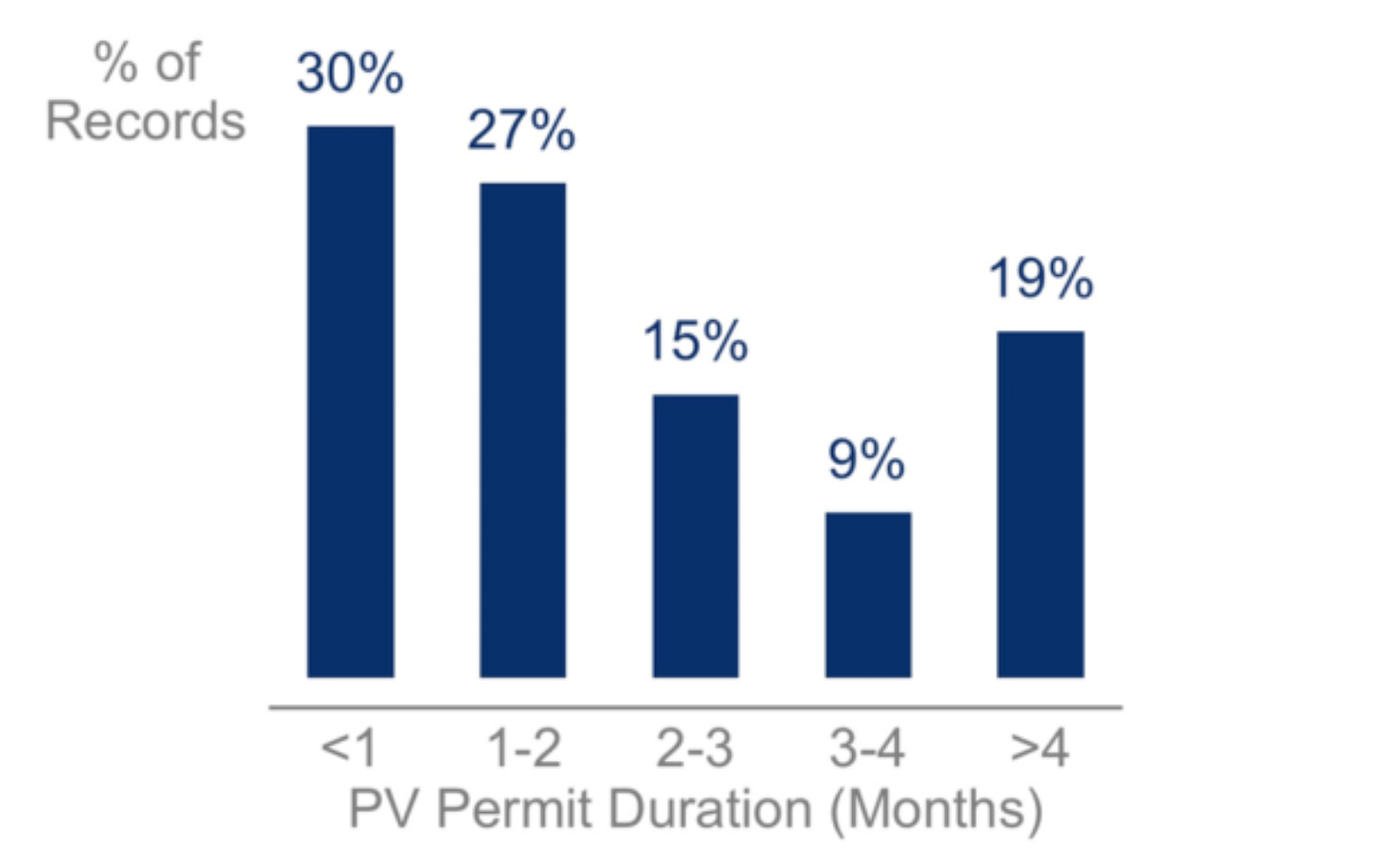

In other places, it’s not so easy. There’s meaningful variance (of up to months!) when it comes to permitting duration which is due to local permitting authorities:

People have taken note and in 2021, the Department of Energy (DoE) awarded the National Renewable Energy Laboratory (NREL) the funds to spin up the Solar Automated Permitting Process+ (SolarAPP+), a platform for local jurisdictions to review solar permit applications in a standardized format. On top of that, California, with its track record for being one of the most climate-forward states, recently passed SB 379 (The Solar Access Act) which requires cities and counties to adopt automated solar permitting processes. Then there’s also the private sector taking matters into their own hands with companies like Aurora Solar extending into permitting. With multiple potential solutions, maybe you think we should just pick one, but I refer to the existence of TurboTax (a multi $billion biz) as evidence for why we shouldn’t always rely on the public sector to craft delightful user experiences for things like filing taxes and in this case, getting permits for solar. Whether it’s via policy changes or private companies, solar permitting will continue to be streamlined with software.

Interconnection

Interconnection is the process of applying and receiving approval from the utility to connect to the grid. From resi to utility-scale, in addition to getting approval from local authorities, you’ll also need permission from the utility. Why connect to the grid at all? Having access to solar isn’t merely enough to transmit electrons to the site of energy consumption. In the case of community solar, electricity that’s generated at the site still needs to be distributed to the end destinations - the homes and other buildings. For resi solar in particular, being hooked up to the grid is necessary in order to participate in net metering - when you sell your excess electricity back to the grid.

Ultimately, interconnection is a textbook case of misaligned incentives. Utility companies, which range in corporate structure, make money by charging consumers for energy consumption. The act of going solar shifts spending away from the utility to the solar company, whether it’s being paid for all-at-once, in installments, or in a power purchasing agreement (PPA). This is overly simplistic because in areas that are already constrained, utilities are happy with less strain on the grid and utilities have been purchasing utility-scale solar projects for quite some time already.

Regardless, you can’t overlook the crippling reality of the interconnection queue. On average, the interconnection review process takes 3.7 years to complete! As a result, almost 3/4 of projects drop out. In Sept. ‘22, there were almost 700 gigawatts of solar + storage in the US interconnection queue. Since this is just in aggregate terms, let me give you a more concrete example.

I recently spoke to Sukrit Mishra, Director at Solar United Neighbors, a non-profit helping people go solar. Sukrit explained that it currently takes 3-4 months from the initial contract signed to the rooftop solar actually working due to bottlenecks in permitting and interconnection. In the past year, they’ve seen an uptick in rejections by PEPCO (utility in the DC area). PEPCO says that their software indicates an unreasonable burden on the secondary grid (the neighborhood level), but when asked for evidence, Sukrit just gets put on an indefinite hold. In order to be actually be approved, PEPCO states that the homeowner has to reduce their consumption load by 50-60% (hard to change lifestyle habits that much) or pay for the upgrade costs. As a result of this hurdle, in one of their recent cooperatives, out of the 49 initial sign-ups, 15 homeowners received interconnection requests and 6 dropped out.

Labor Shortage

Even though there’s significant headroom to reduce soft costs (2/3 of total) with software, installing and developing solar is inherently a physical feat. You can’t escape the reality that someone still has to climb the rooftop or in the case of utility-scale, a construction crew going onsite to assemble the array of PV modules. In the US, due to a variety of reasons, including an aging workforce and tough working conditions, there’s a massive labor shortage in the skilled labor trades. This problem alone deserves an entire post which is why I’ll be covering the labor shortage in clean energy trades in a future Launchpad.

Predictions & Open Questions

Solar companies expanding into adjacent categories

The biggest problem with renewables like solar and wind is intermittency. The sun doesn’t always shine and the wind doesn’t always blow. To combat this, we’ve learned to leverage batteries AKA storage to capture excess energy and store it for future usage. Across all aspects of solar, the synergistic bundling of solar with storage is near ubiquitous. In addition to storage, adjacent areas like energy efficiency and EV charging will be offered by solar companies as they adapt to meet customer needs. Solar companies will mirror their customers’ holistic view on home electrification and offer a wider suite of products and services.

Recycling

The average lifetime of a solar module is 25 years although its generation efficacy degrades in a roughly linear fashion. We’re fast approaching the point where some of the OG solar modules need to be retired. Solar modules comprise of silicon, semiconductor materials, and plastics along with racking that’s mostly aluminum and steel. How are we going to efficiently recycle these materials? Is there an actual business to be built? This process is highly intensive in logistics and labor, but I’m optimistic that the trajectory of the solar supply chain can be bent to resemble somewhat of a circular economy (like where we’re seeing in fashion).

What happens to the long-tail of solar installers?

There’s a plethora of local SMBs that offer solar products and services. From my direct research, these companies are hesitant to adopt the latest tech, instead opting for phone calls, spreadsheets, and email. Although they compete against giants like Tesla and SunRun, they have the local advantage which results in superior customer service. As solar learning curves continue to advance and adoption increases, I expect more consolidation at the regional level, but not any wider. After all, there’s a reason why there isn’t a massive national roofing or plumbing business.

How do we bring solar to renters and multi-tenant buildings?

Let’s be real. Although prices have come down a lot, solar is still a several thousand dollar commitment. With breakeven points of 5-7 years, it often makes sense if you’re a homeowner. However, the math gets a bit blurry for renters, and policies can get in the way for people that live in apartments and condos. Sure, there are alternatives like Arcadia that enable you to purchase from community solar, but that doesn’t service everyone. How do we better align the incentives between landlords and renters? How do we make it easier for residents in quadplexes or co-op buildings to pool their resources together to go solar? I think the solution is a combination of policy reform combined with a nifty fintech product that allows you to groupbuy solar with your homies (and landlord).

Closing Thoughts

Solar is now mainstream enough that people are aware, but it hasn’t reached mass adoption yet. Less than 4% of US homes and less than 2% of commercial buildings have gone solar. I’m excited for software to continue the acceleration in adoption and deployment of this marvelous technology that converts an infinite resource 🌞 to electricity.

For those doubting whether the opportunity exists given the presence of large incumbents: allow me to highlight the fact that SunPower (a publicly traded $3B solar company) responded to my interest in their services by sending me an email with a logo that still has a grid background (guess they still gotta learn about the .png format). I also find it amusing that question #12 is in all caps.

There’s so much that I didn’t cover today. From virtual PPAs to SRECs to supply chain issues, there’s a lot more to discuss! In the next newsletter, I’ll dive into home electrification - what it is and why it’s important. If you enjoyed this piece, please share it! To stay in the loop on new posts, subscribe to this newsletter and follow Build in Climate on Twitter.